We have provision to define different tax rates for each country based on billing or delivery address. Kindly follow below steps to configure the vat settings in your administration panel:

1. First you will require to set the VAT rates in the shop, So navigate to Configuration > catalog > Tax rates (VAT)

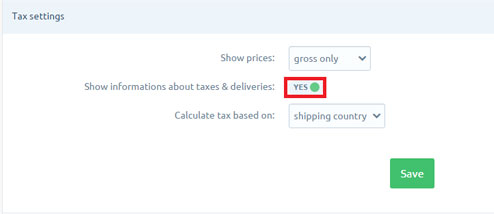

2. Enable the option 'Show informations about taxes & deliveries'

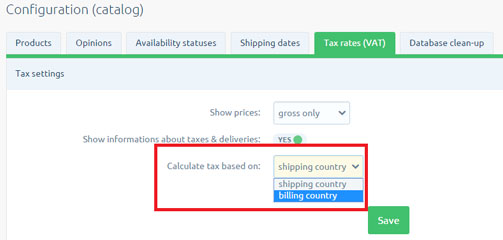

3. In the next step, check whether the VAT is to be charged according to the shipping country or payment and save the settings.

DETERMINATION OF TAX CLASSES

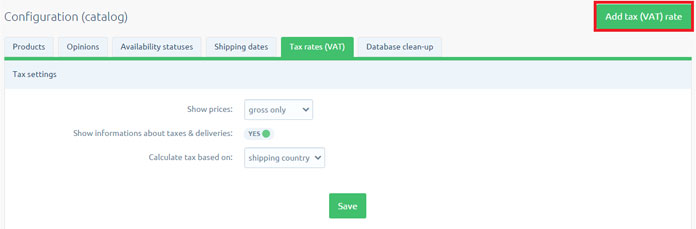

1. To add new tax rate click on top right button 'Add tax (VAT) rate'

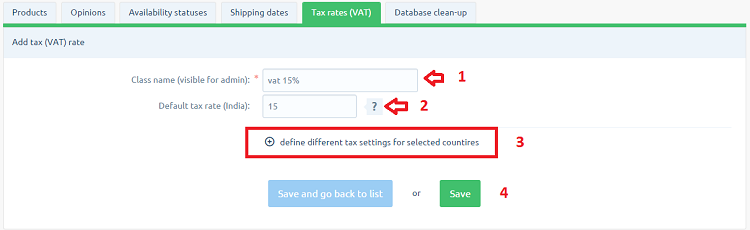

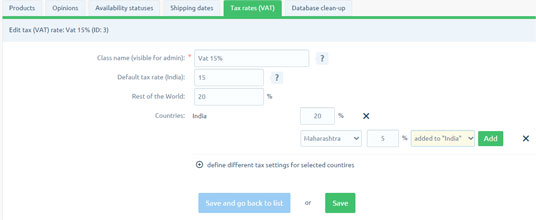

2. Specify the class name and the default value of VAT and Choose the country for which you want to specify a separate VAT by clicking on 'define different tax settings for selected countires'

3. In this area you can define the tax values for the required countries by just selecting the country name from the drop-drown and assigning the tax values to it.

Note : Here only for India and USA you have provision to define the tax values for states too.

4. You can also specify the VAT rate for other unspecified countries by setting the vat for rest of the world.

The price with tax and without tax would be displayed on the 'product details' page which you can restrict if you wish to by disabling the option 'Show information about taxes and deliveries to NO'. The entire tax information for customers is shown on the checkout page.

GENERAL INFORMATION

> Tax rates and the value presented in the basket, are determined based on the country of delivery or the country of payment.

> Products and supplies may have different tax classes.